Page 1 (0s)

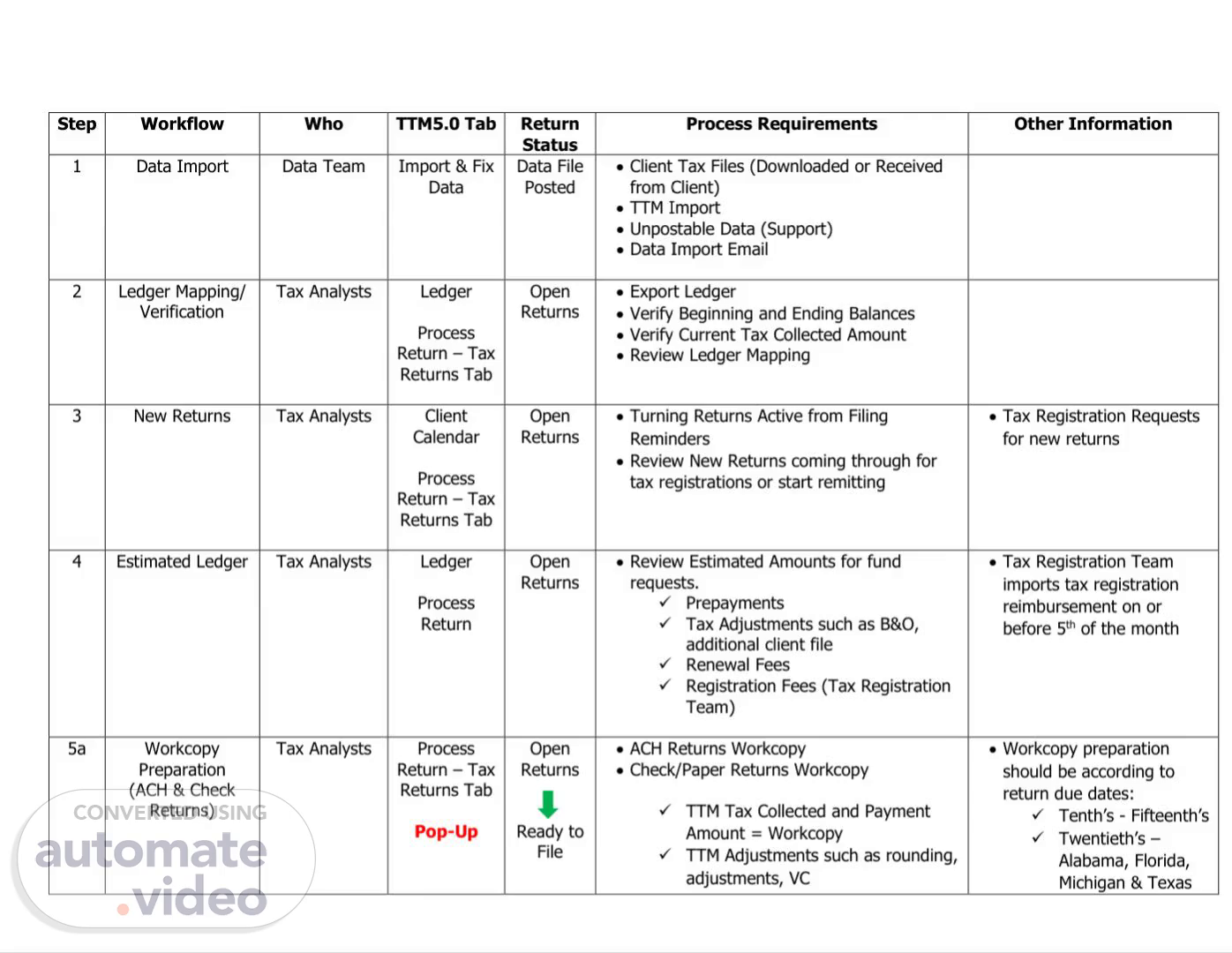

[Audio] Step Workflow Who TTM5.0 Tab Return Status Process Requirements Other Information 1 Data Import Data Team Import & Fix Data Data File Posted Client Tax Files (Downloaded or Received from Client) TTM Import Unpostable Data (Support) Data Import Email 2 Ledger Mapping/ Verification Tax Analysts Ledger Process Return – Tax Returns Tab Open Returns Export Ledger Verify Beginning and Ending Balances Verify Current Tax Collected Amount Review Ledger Mapping 3 New Returns Tax Analysts Client Calendar Process Return – Tax Returns Tab Open Returns Turning Returns Active from Filing Reminders Review New Returns coming through for tax registrations or start remitting Tax Registration Requests for new returns 4 Estimated Ledger Tax Analysts Ledger Process Return Open Returns Review Estimated Amounts for fund requests. Prepayments Tax Adjustments such as B&O, additional client file Renewal Fees Registration Fees (Tax Registration Team) Tax Registration Team imports tax registration reimbursement on or before 5th of the month 5a Workcopy Preparation (ACH & Check Returns) Tax Analysts Process Return – Tax Returns Tab Pop-Up Open Returns Ready to File ACH Returns Workcopy Check/Paper Returns Workcopy TTM Tax Collected and Payment Amount = Workcopy TTM Adjustments such as rounding, adjustments, VC Workcopy preparation should be according to return due dates: Tenth’s - Fifteenth’s Twentieth’s – Alabama, Florida, Michigan & Texas.