PowerPoint Presentation

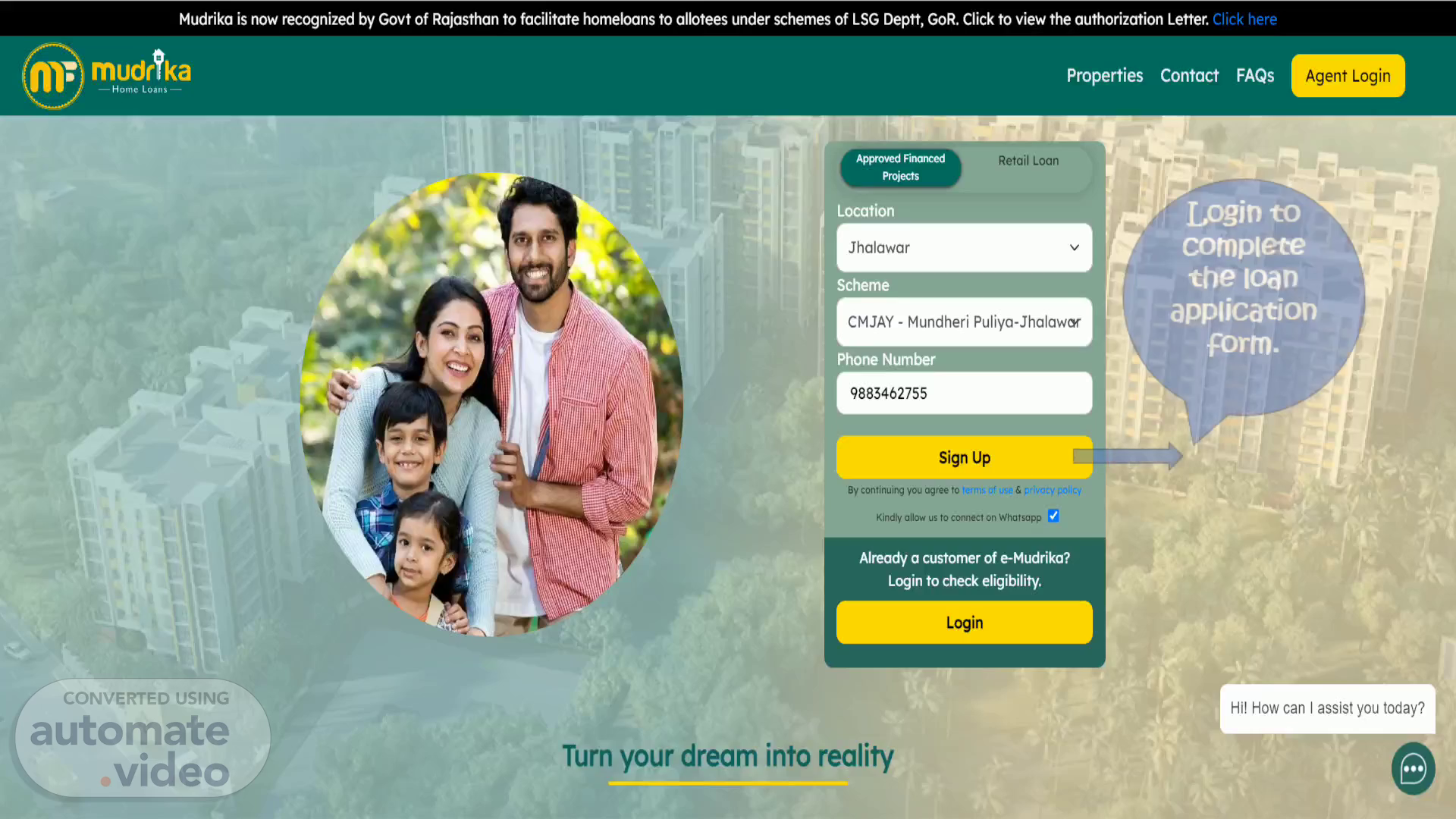

Scene 1 (0s)

[Audio] Mudrika finance is a market place that enables customers to get the best credit options from various lending partners. Borrowers interested in home loans can select from wide range of APF projects listed on our website, they can also raise retail home loan requests..

Scene 2 (18s)

[Audio] Borrowers can also choose to complete the application by providing data via whatsapp chatbot. Whatsapp chatbot provides various options to customer they can complete the process of loan application, check their home loan eligibility or even raise service requests..

Scene 3 (36s)

[Audio] Applicants needs to provide the KYC details along with employment information for Lending partners to process the file..

Scene 4 (45s)

[Audio] Applicants needs to upload the required document such as Aadhaar Card in order to complete the application..

Scene 5 (53s)

[Audio] Applicants needs to complete the loan application by providing the Loan amount that they are looking to borrow..

Scene 6 (1m 1s)

[Audio] Customer can calculate their home loan eligibility and even check their credit score via links which is shared to them once the customers loan applications starts processing..

Scene 7 (1m 20s)

[Audio] Both Lending partners and real estate developers are given the dashboard by Mudrika finance, so that they can track the leads which is shared with or by them..

Scene 8 (1m 38s)

[Audio] Lead which is shared with the lending partner is visible to them as offers and the real estate developers are given birds eye view of the whole process. Lending partners can select the status from the pipeline to let us know about the status of the customers loan process..

Scene 9 (2m 8s)

[Audio] Once the lead is processed by the lending partner customer can select the offers which are visible to them. On acceptance of the offer loan disbursal process will start. Along this journey Mudrika finance stays connected to all the stakeholder and help in hassle free execution of the credit facilitation process..