Page 1 (0s)

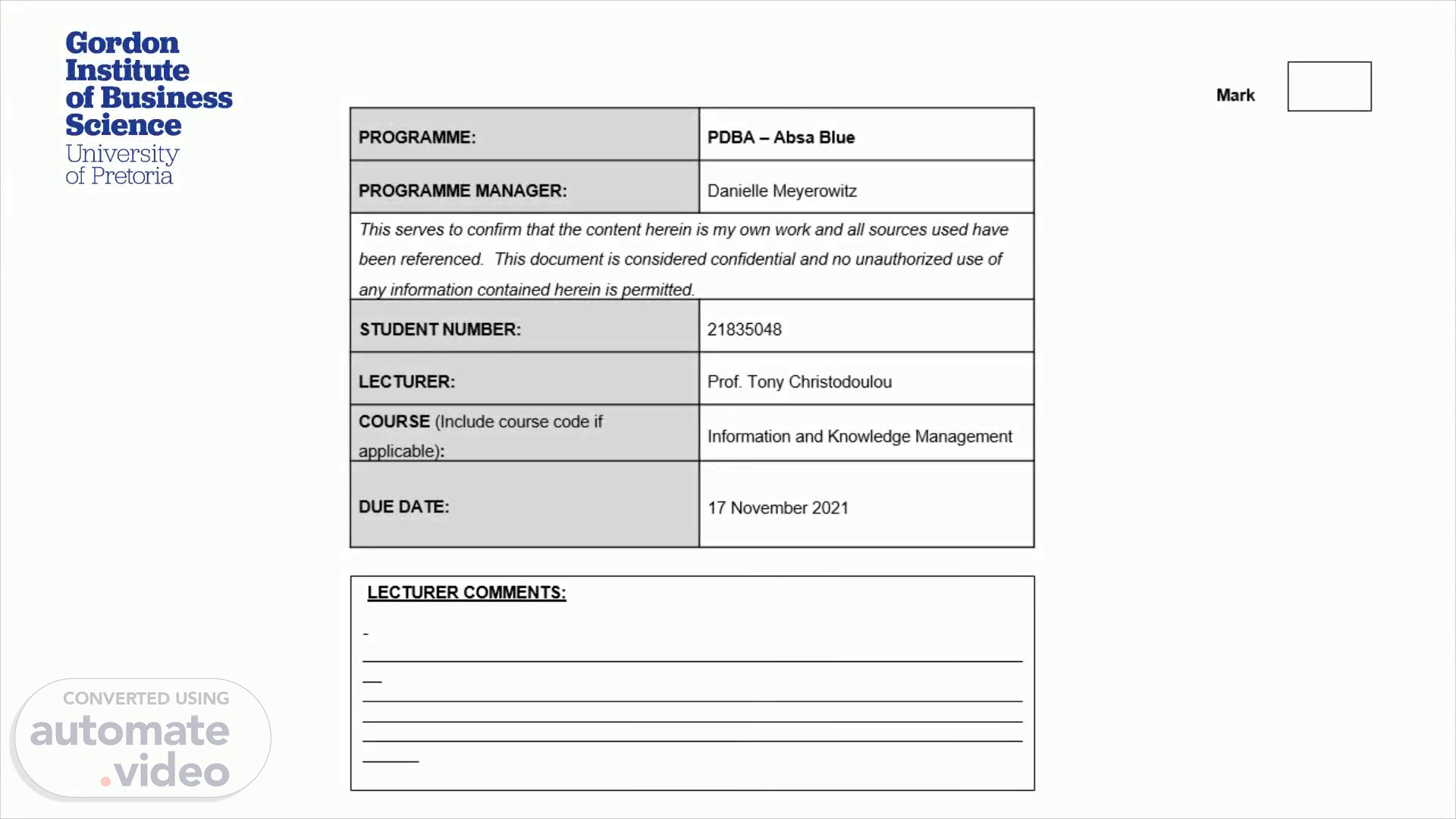

PROGRAMME: PDBA – Absa Blue PROGRAMME MANAGER: Danielle Meyerowitz This serves to confirm that the content herein is my own work and all sources used have been referenced. This document is considered confidential and no unauthorized use of any information contained herein is permitted. STUDENT NUMBER: 21835048 LECTURER: Prof. Tony Christodoulou COURSE (Include course code if applicable) : Information and Knowledge Management DUE DATE: 17 November 2021.

Page 2 (24s)

67 Top Online Collaboration Tools for Remote Teams (2021).

Page 3 (44s)

Contents. The problem / opportunity The analysis of the problem / opportunity Proposed approach Proposed plan In summary.

Page 4 (1m 6s)

[Audio] Standard Bank Group are serious about changing the way they do business in this new and dynamic world. As can be seen on their Group website, their strategy acknowledges the fact that we are living in a world where technology is evolving and as a result, so are customers' expectations of Banking. And as a result they are making this their focus by responding to these expectations by "strengthening" there capabilities and increasing integration to ensure great customer experiences and to ensure that they are operating efficiently. To achieve this, one of the key decisions made by the Group Executives is to merge the IT Businesses from both the Corporate and Investment Banking and the Personal and Business Banking Business units. In doing this, they will not only benefit from economies of scale, but will also enable them to deliver a consistent customer experience through this integrated shared service business. Theoretically and superficially, this is a sound business decision, however, there are underlying considerations which need to be addressed. These considerations can become hindrances or problems in making this decision a successful one. These include (as noted by Dr Reddy Kandadi in his 2020 TedX talk): Culture – which includes People Processes Infrastructure.

Page 5 (3m 41s)

[Audio] Now that we know what the problems or key elements are, lets unpack them in a little more detail. On the topic of culture merge. These two teams already have their knowledge " Embrained which needs to be converted into explicit knowledge without the fear of them losing their " IP" which they may fear will result in them possibly becoming replaceable. It is always good to start with the "end in mind" and taking the senior managers on the journey from the outset will not only create a common understanding of the end state and the why, but it will also allow them to understand the value that it will add to the overall organisation Processes – we already appreciate that these are two totally different businesses with their own sets of processes and generally how they conduct and deliver on their business objectives. They also service different client types which may result in certain processes remaining different. However, there may also be a considerable amount of overlap, duplication and wastage which will add business and customer value when optimized. Dynamic capabilities is Standard Bank's ability to enable processes around " coordination, learning and reconfiguration" Lastly, in the case of infrastructure and technology. This doesn't only relate to computers, but rather the environment and technology enablers. Collaboration is key in connecting and collaboration. Dr Reddy Kandadi refers to the concept of the " Water cooler" as a symbol of an informal environment driving innovative collaboration.

Page 6 (5m 27s)

[Audio] We have covered the problems, but what could an approach look like in order to mitigate these challenges or problems? Lets start by unpacking the culture merge / people. As humans, we all know that there is this inherent fear of becoming irrelevant or displaced through any merger or re-organisation. As a result we tend to hold on to our tacit knowledge and avoid sharing which becomes more damaging than good for any organisation, especially the culture. It is important to, at the outset, create and embed a culture of sharing, learning and combined growth. In order to get to a point of collaboration, and the first way that this could be achieved is through Senior Management working as one cohesive team. Let's consider this through the application of the SECI Model. Lets unpack this model as well as the elements which Standard Bank could consider as an approach: S is for Socialisation. This is all about Tacit to Tacit learning and learning through sharing. One of the most commonly used tools for Socialisation is Brainstorming. Brainstorming can be a great collaboration tool as it allows for individuals to share their knowledge, ideas and creativity in a non-traditional corporate meeting setting. One way which this could work within the two IT teams is for the senior management team and the executives to get together and arrange a breakaway which will create a platform for the senior managers to be part of the solutioning for this. Articulating the need and the desired end state and the value that it will create for the Standard Bank business at a Group level will allow them an understanding of the value that this process can and will create. If the entire senior management team is part of the solutioning and design through sharing of their combined knowledge and experiences, they are able to become advocates and mobilise their respective teams. Regular informal breakaways are needed whilst during the forming and storming phase of team creation. E is for externalization – and is really about converting tacit knowledge into explicit knowledge, also known as " Encoded Knowledge". This typically happens through knowledge sharing sessions. A recommendation for this is regular informal " information sharing sessions" where nominated experts take the "hot seat" and share with the greater group some of their experiences and impart some knowledge The last element which I would like to focus on in the Standard Bank context is Internalisation. The reason why this is so important is because it allows the consumers of the information to apply their learning. It is one thing to impart knowledge and training, but to actually put this into action is where the power is unlocked and where true development and learning takes place. Standard Bank should consider a job-rotation program, where it requires individuals from each of the two business to rotate across the two IT teams in an attempt to better understand and put into practice the learnings. It also assists individuals with a means of diversifying their skills and understanding more broadly..

Page 7 (8m 42s)

[Audio] Business processes are key to creating a pathway to the creation of a desired culture "How we do things" and adoption of technology and data centricity. LEAN methodology is a great way in creating this process assessment, because the reality is that the convergence / merger of two business unit will create a duplication of processes in many instances. This needs to be alleviated in order to drive more value to your customers..

Page 8 (10m 41s)

[Audio] To coin a comment made by Dr Reddy Kandadi in one of his TedX talks he says that " infrastructure is more than just computers" it is more about the physical environment that create space for collaboration and innovation. He introduces the concept of the " Water Cooler". In a typical and traditional Pre-COVID office set up, people would generally meet their colleagues at the water cooler or coffee shop. This informal setting often gave or gives rise to creativity and creating a collaborative solve for a business problem. In order to ensure that the two teams collaborate, engage and share knowledge, where they are physically based or located makes a massive difference in the success or failure of this merger / convergence of the two businesses..

Page 9 (12m 51s)

[Audio] So, what could a typical plan look like on the road to success. In order to depict this, I will be using the IKM execution framework, simply because it contains critical components required for the implementation of a successful plan. First and foremostly – always start with the end in mind. What is it that needs to be achieved? Standard Bank wants to transform the business through integration, enhanced customer experience and driving of operational efficiencies. The major output / business benefit is cost reduction through economies of scale, improved efficiencies driving improved Turn Around Times ultimately creating a great customer experience. The road to success requires a well thought through and executed Change Management plan involving ALL stakeholders but focusing on the senior management to be part of the journey at the outset Enablers in the through socialization, externalization and internalization tools To better influence the staff and leadership buy in is to influence behavior through the linking of goals to the desired outputs, creation of the sharing culture Having access to data and insights is critical, a major challenge in this instance would be the convergence or merging of the two data sets and systems in order to generate a standardized manner of reporting and definitions. This is critical in order to measure and track the progress of this merger pre and post. Continuous improvement creates a framework for constant monitoring and where needed, improvements and adjustments to be made where the activities are not achieving the desired outcome Policies and procedures – these need to be combined in a manner that does not negatively or adversely impact the key outputs to be achieved Measuring, reporting and tracking post merger is an important factor to ensure success or failure of the key outcomes / outputs Knowledge transfer through the physical set up, sharing sessions and other digital tools A detailed execution plan together with timelines, clearly defined objectives and assigned roles and responsibilities is key to enabling the meeting of these objectives. Without an execution model, this will result in misalignment, uncertainty and ultimately, objectives not been met.

Page 10 (16m 46s)

In order for Standard Bank to radically change in line with their customer’s needs and expectations, it need to look at consolidating the CIB and PBB IT teams as this will create greater organizational and customer value through: Reduced TAT’s Enhanced customer experience Reduced costs through economies of scale.

Page 11 (17m 49s)

References. Christodoulou, T. (2021). Day one: Information & Knowledge Management Day 1 [ Powerpoint slides]. Retrieved from GIBS Blackboard: http://gibs.blackboard.com Christodoulou, T. (2021). Day two: Information & Knowledge Management Day 2 [ Powerpoint slides]. Retrieved from GIBS Blackboard: http://gibs.blackboard.com GIBS Business School. (2021, November 15). Kondal Reddy Kandadi : Knowledge Management and Innovation. Retrieved from https://youtu.be/DNUwZctwwhw Lucas, H.C., and Goh, J.M. (2009). Disruptive technology: How Kodak missed the digital photography revolution, The Journal of Strategic Information Systems, March 2009, Volume 18 Issue 1, pp 46–55. McCahill , L. (2014, July 21). Great ideas don’t happen in the boardroom . Medium.com. Retrieved from https://medium.com/the-happy-startup-school/great-ideas-dont-happen-in-the-boardroom-edbbb6c64f45 Scurtu , L.E., & Neamțu , D.M. (2015). The need of using knowledge management strategy in modern business organizations., USV Annals of Economics & Public Administration . 2015, Volume 15 Issue 2, pp 157-166..