Scene 1 (0s)

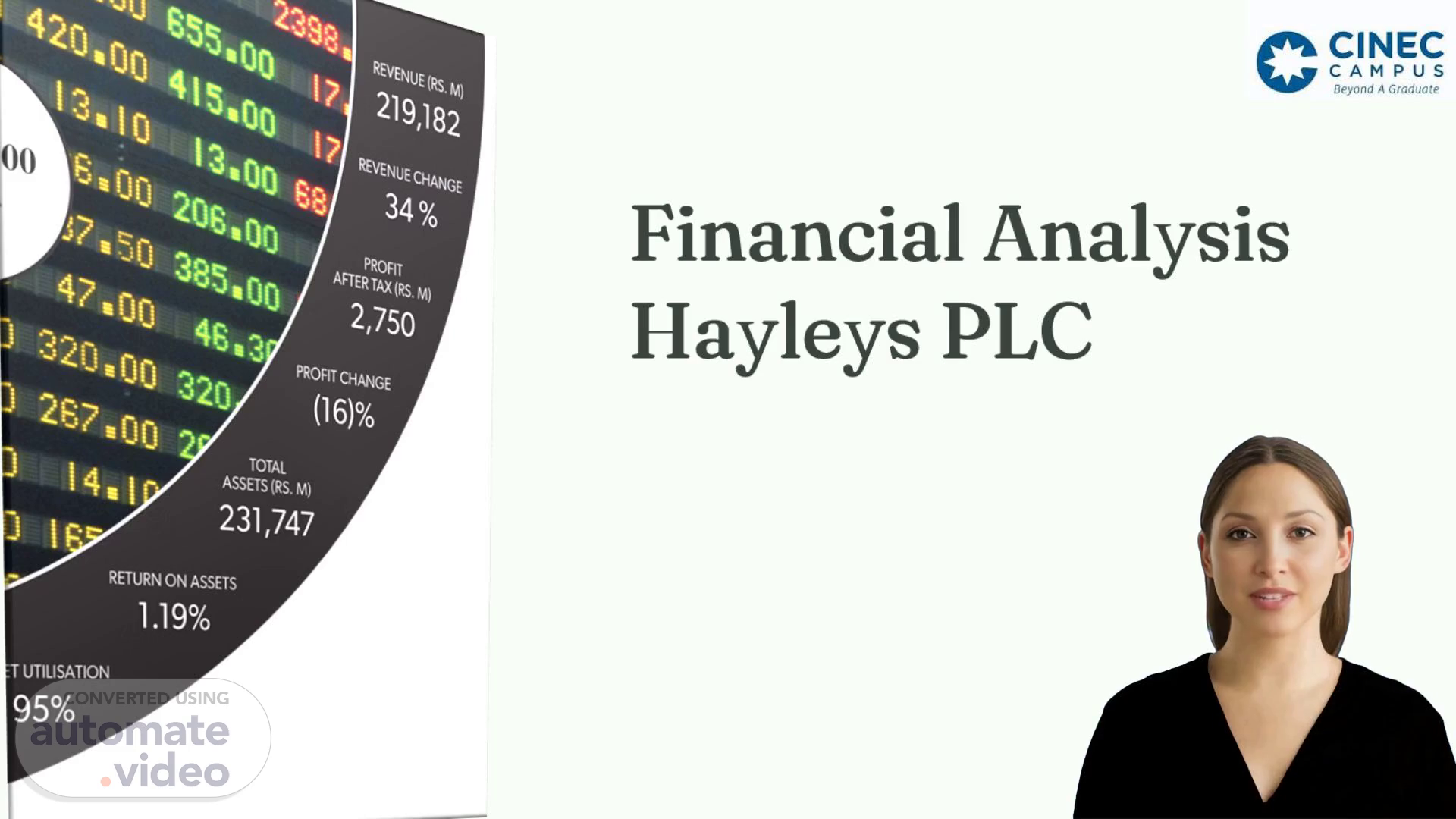

[Virtual Presenter] Hello everyone, Today, we will be discussing the financial analysis of Hayleys P-L-C--, a diversified conglomerate with operations in various sectors. Founded in 1878, the company is committed to sustainability and ethical business practices. The financial analysis presented includes a comprehensive understanding of the company's performance over multiple years. We hope this presentation will be informative and helpful for all of you..

Scene 2 (28s)

[Audio] Financial Performance Analysis Overview of Hayleys P-L-C Financial Statement Analysis Financial Ratio Analysis Cashflow Analysis Understanding Hayleys PLC's Financial Performance.

Scene 3 (42s)

[Audio] Hayleys P-L-C is a diversified conglomerate with a rich history in Sri Lanka. The company operates in a range of sectors including plantations, consumer goods, industrial products, and engineering. Hayleys PLC's strong focus on sustainability and ethical business practices has been a driving force in its growth and success. The company was founded in 1878 and is headquartered in Colombo, Sri Lanka. Hayleys P-L-C has over 145 years of operation and operates in more than 16 diverse business sectors. It has a global reach with a presence in over 80 countries and a workforce of over 30000 employees. Hayleys PLC's business sectors include manufacturing, consumer and retail, leisure, transportation and logistics, energy and environment, and construction and energy. The company is a leading exporter in coconut-based products, rubber gloves, and activated carbon, and a significant contributor to Sri Lanka's G-D-P through export revenues..

Scene 4 (1m 37s)

[Audio] Financial Statement Analysis for Hayleys P-L-C involves evaluating financial statements to assess a company's performance and make informed decisions. There are three main types of financial statement analysis: Horizontal Analysis, Vertical Analysis, and Trend Analysis. Horizontal Analysis compares financial data over multiple periods to identify trends and growth patterns. This analysis is useful when comparing the financial performance of a company over time or when comparing the financial performance of different companies in the same industry. Vertical Analysis presents financial statements as percentages of a base figure to enable easy comparison of performance across companies or periods, highlighting the relative size of each component. This analysis is useful when comparing the financial performance of a company to a benchmark or to industry averages. Trend Analysis involves analyzing financial data to identify patterns and trends over time, which is useful for forecasting future financial performance or identifying areas for improvement. Overall, Financial Statement Analysis is a valuable tool for assessing a company's financial performance and making informed decisions. By using Horizontal Analysis, Vertical Analysis, and Trend Analysis, we can gain a deeper understanding of a company's financial performance and make better decisions..

Scene 5 (3m 2s)

[Audio] We will analyze Hayleys PLC's financial performance using horizontal analysis. This analysis compares the financial performance of a company over a period of time, typically two to five years. We will focus on Hayleys PLC's revenue growth from 2019 to 2023. In 2019, Hayleys P-L-C generated a revenue of 1599170. From 2019 to 2020, Hayleys PLC's revenue increased by 361%, from 1599170 to 2198744. From 2020 to 2021, Hayleys PLC's revenue increased by 11%, from 2198744 to 2418628. From 2021 to 2022, Hayleys PLC's revenue increased by 389%, from 2418628 to 3338516. From 2022 to 2023, Hayleys PLC's revenue increased by 482%, from 3338516 to 4922094. As we can see, Hayleys P-L-C has experienced significant revenue growth over the past four years..

Scene 6 (4m 37s)

[Audio] We will examine Hayleys PLC's financial performance. We will first look at the total revenue generated by the company. In the past year, Hayleys PLC's revenue has increased by 29.82%. We will then examine the difference between the cost of goods sold and the revenue generated, which represents the company's gross profit. Hayleys PLC's gross profit has increased by 28.01%. We will also look at the company's earnings before paying any taxes, which is referred to as profit before tax. Hayleys PLC's profit before tax has increased by 56.47%. Finally, we will examine the profit margins, which are calculated as a percentage of the revenue generated. The profit margin for turnover is 2.92%, while the profit margin for profit before tax is -56.47%. This indicates that the costs are outpacing the revenue growth..

Scene 7 (5m 31s)

[Audio] We analyzed Hayleys PLC's financial performance over the past six years. Our examination of trends in gross profit and profit before tax revealed that gross profit increased from 388745 in 2012 to 608270 in 2017, representing a steady improvement in the company's profitability. Additionally, the profit before tax also increased from 400102 in 2012 to 140913 in 2017, indicating that the company's overall financial performance has been positive over the past six years. However, it is important to note that the increase in gross profit and profit before tax is largely due to the increase in sales revenue, rather than any improvements in the company's operational efficiency..

Scene 8 (6m 26s)

[Audio] Financial ratios are essential tools for evaluating a company's financial performance and stability. Understanding the different types of financial ratios can help you make more informed decisions about investing in a particular company..

Scene 9 (6m 40s)

[Audio] We will examine the profitability ratios of Hayleys P-L-C--. We will look at the Return on Capital Employed (R-O-C-E-), Return on Equity (R-O-E--), Operating Profit Margin, and Assets Turnover ratio. The first ratio we will examine is the roce. This ratio shows the return on the capital invested in the company. It is calculated by dividing profit before interest and tax (P-B-I-T-) by total equity. For the fiscal year 2021, Hayleys PLC's roce was 55.19%. This is an improvement from the previous year. However, it is still below the industry average of 58.66%. Next, we have the R-O-E--. This ratio measures the return on the shareholder's investment. It is calculated by dividing profit after interest and tax by total equity. For the fiscal year 2021, Hayleys PLC's R-O-E was 50%. This is an increase from the previous year. However, it is still below the industry average of 50%. We also looked at the Operating Profit Margin. This ratio shows the profitability of the company's operations. It is calculated by dividing P-B-I-T by revenue. For the fiscal year 2021, Hayleys PLC's Operating Profit Margin was 344.94%. This is an increase from the previous year. However, it is still below the industry average of 704.67%. Finally, we looked at the Assets Turnover ratio. This ratio shows how efficiently the company is using its assets to generate profits. It is calculated by multiplying the operating profit margin by asset turnover. For the fiscal year 2021, Hayleys PLC's Assets Turnover was 16%. This is an increase from the previous year. However, it is still below the industry average of 7%. In conclusion, while Hayleys P-L-C has made improvements in some of its profitability ratios, there is still room for improvement in others. It will be interesting to see how these ratios change in the future..

Scene 10 (8m 48s)

[Audio] We will discuss Hayleys PLC's financial analysis and examine their ability to meet short-term obligations using the current ratio and the quick ratio. The current ratio is calculated by dividing current assets by current liabilities. Hayleys PLC's current ratio is 100.08%, indicating that they have more current assets than current liabilities. The quick ratio is calculated by subtracting stock from current assets and dividing the result by current liabilities. Hayleys PLC's quick ratio is 100.04%, indicating that they have enough current assets to cover their current liabilities, even if they need to sell some of their inventory. Overall, these liquidity ratios provide valuable insights into Hayleys PLC's ability to meet short-term obligations and maintain a healthy financial position..

Scene 11 (9m 40s)

[Audio] Financial Ratios Receivables Collection Period Calculation: Average Accounts Receivable / Average Credit Sales x 365 Days Indicates How Long it Takes for a Business to Collect Its Outstanding Receivables Shorter Period Generally Considered More Efficient Inventory Holding Period Calculation: Average Inventory / Average Cost of Sales x 365 Days Indicates How Long a Business Holds Its Inventory Before Selling It Shorter Period Generally Considered More Efficient Payables Payment Period Calculation: Average Accounts Payable / Average Credit Purchases (or Cost of Sales) x 365 Days Indicates How Long a Business Takes to Pay Its Outstanding Payables Shorter Period Generally Considered More Efficient.

Scene 12 (10m 26s)

[Audio] We will analyze the financial ratios of Hayleys P-L-C--, specifically focusing on the gearing ratios. Our analysis will include the debt to equity ratio and the debt to debt plus equity ratio. We will then calculate the interest cover. The debt to equity ratio for Hayleys P-L-C is 529.46%, 418.07%, and 549.72% respectively. The debt to debt plus equity ratio is calculated by dividing non-current liabilities by the sum of ordinary shareholders funds and non-current liabilities, and then multiplying the result by 100%. The debt to debt plus equity ratio for Hayleys P-L-C is 84.11%, 80.70%, 84.61%, and 67.09% respectively. Moving on to interest cover, we can calculate it by dividing operating profit by finance costs. It's important to note that a negative interest cover indicates that the company is not generating enough cash to cover its interest expenses..

Scene 13 (11m 42s)

[Audio] We will focus on cash flow analysis. It is a vital tool for evaluating a business’s financial health and liquidity. It involves assessing the inflows and outflows of cash over a specific period. We will examine operating activities, which include the primary revenue-generating activities of the business, and invest activities, which involve the purchase and sale of long-term assets and investments. Finally, we will discuss financial activities, which include the payment of dividends, repayment of debt, and changes in equity. By analyzing these three categories of activities, we can gain a comprehensive understanding of Hayleys PLC’s financial health and liquidity..

Scene 14 (12m 19s)

[Audio] We will discuss the net income generated by Hayleys PLC's core business activities, capital expenditures, and investments in long-term assets, as well as the net income from financial activities such as interest and taxes. The operating activities section for the year 20XX show an increase in net income, primarily due to improvements in operating efficiency and cost control measures. The investment activities section for the same year show a decrease in net income, primarily due to increased capital expenditures on long-term assets. The financial activities section for the year 20XX show a decrease in net income, primarily due to increased interest expenses resulting from the issuance of debt. The cash and cash equivalents at the end of the year section for the year 20XX show a decrease from X to Y, primarily due to increased operating expenses and capital expenditures. By analyzing the cashflow statements, we can determine a company's ability to generate cash and meet its financial obligations..

Scene 15 (13m 18s)

[Audio] In this section, we discuss the Dupont Analysis, a financial framework that identifies the factors affecting a company's profitability and efficiency. This analysis breaks down Return on Equity (R-O-E--) into three components: Net Profit Margin, Total Assets Turnover, and Equity Multiplier. The Net Profit Margin measures the profit made for every dollar of sales, reflecting overall profitability. It is critical in determining a company's financial health and profitability. The Total Assets Turnover indicates how efficiently a company uses its assets to generate sales, revealing insight into its operational efficiency and asset management, which is essential in understanding a company's potential for future growth. The Equity Multiplier illustrates the level of financial leverage used, indicating how much of the company's assets are financed by shareholders' equity. It is crucial in determining a company's financial risk and its ability to generate returns for its shareholders. By examining these three components, we gain a deeper insight into a company's financial performance and potential for future growth..

Scene 16 (14m 26s)

[Audio] Hayleys PLC's financial performance will be analyzed using the Dupont Analysis. The Net Profit Margin, Total Assets Turnover, Equity Multiplier, and Return on Equity (R-O-E--) will be examined to gain insights into the company's financial health..

Scene 17 (14m 43s)

[Audio] Terima kasih telah mengikuti presentasi kami tentang Analisis Keuangan Hayleys P-L-C--. Kami berharap presentasi ini telah memberikan Anda pemahaman yang lebih baik tentang perusahaan ini. Sebelum kami mengakhiri presentasi ini, kami ingin mengucapkan terima kasih kepada para anggota kelompok kami yang telah bekerja keras untuk menyusun presentasi ini. Kami mengucapkan terima kasih kepada Y A N Madushani, A A E H Amarathunga, L A D M I Mihirangi, S M C E Jayasekara, W A D P M T N.Aththanayaka dan Binuri Parindaya atas kontribusi mereka yang berharga. Selanjutnya, dengan ini kami mengumumkan bahwa presentasi kami telah mencapai akhirnya. Terima kasih kepada semua yang telah mendengarkan, kami harap Anda telah mendapatkan wawasan yang bermanfaat dari presentasi ini. Sekali lagi, terima kasih dan sampai jumpa!.