Scene 1 (0s)

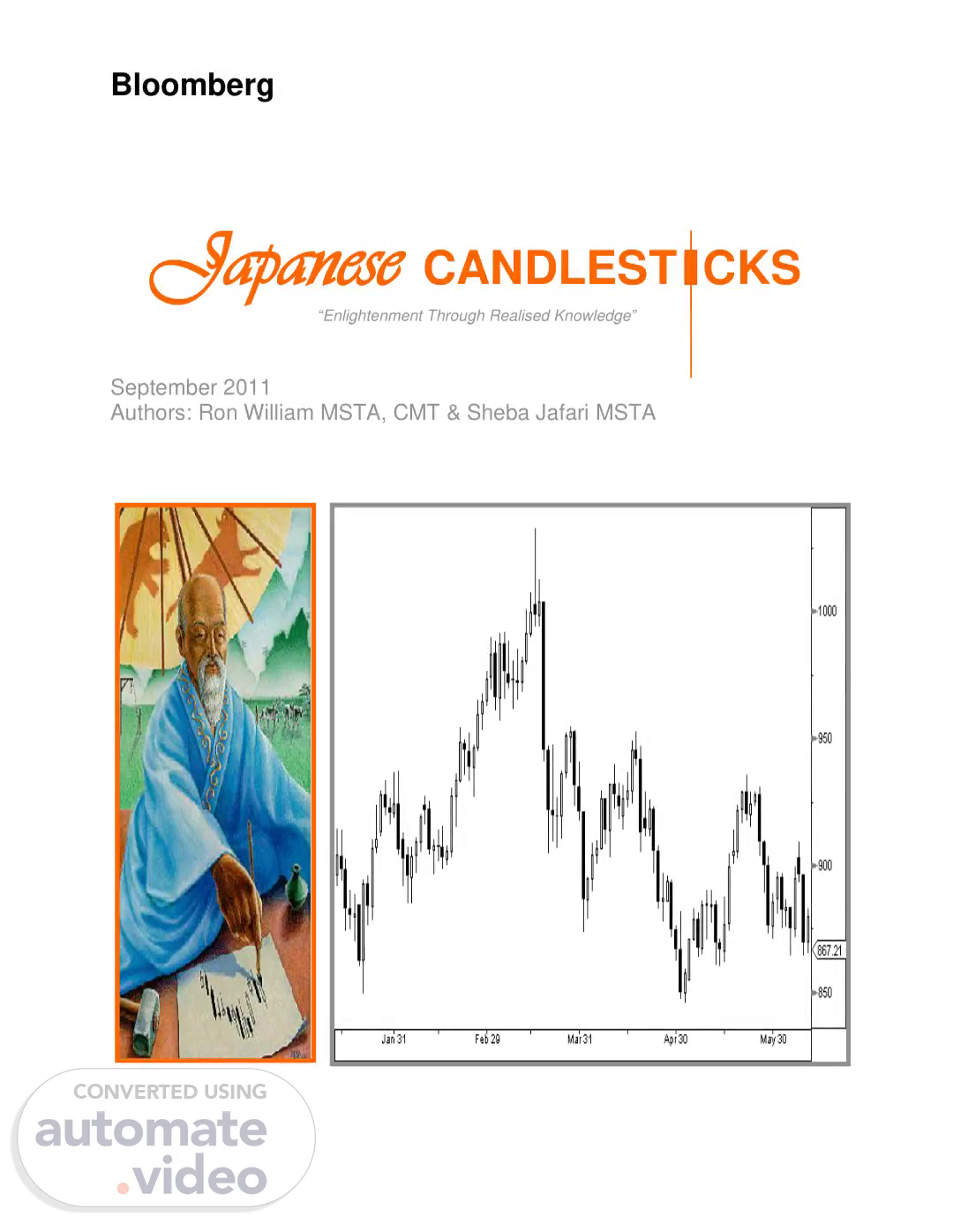

. . Bloomberg. Japanese CANDLEST CKS. “Enlightenment Through Realised Knowledge”.

Scene 2 (11s)

. . 2. Bloomberg Contents INTRODUCTION. Historical footprints…………………………………………………..…….3 Why use Japanese Candlesticks?.......................................................4 Intrinsic price movement and psychology……….................................5 Candlestick construction………...…………….……..............................6.

Scene 3 (45s)

. . 3. Three Black Crows……………………………………………………….23 Tasuki Gap………………………………………………………………..24 Gapping Side-by-Side White Lines…………………………………….25 Advance Block……………………………………………………………26 Abandoned Baby…………………………………………………………27 Rising Three Method/Falling Three Method…………………………...28.

Scene 4 (1m 1s)

. . 4. Bloomberg Historical Footprints… “Let history navigate the future” Japanese Candlestick charting and techniques is one of the most effective ways to read price movements in the financial market. The methodology, so called because of its similarity to a candle, has been developed over the centuries in Eastern Asia. It was originally used in Japan, during the Edo-period (1603-1868), to monitor and forecast price movements of the country‟s most prized commodity, rice; which was mostly traded at the Dojima Rice Exchange near the historical commercial capital, Osaka. Widely based on military tactics of the time, Japanese Candlestick techniques have provided traders with an edge, long before bar and point and figure charts, while evolving into a compelling strategy for today‟s fast and volatile markets..

Scene 5 (1m 37s)

. . 5. Bloomberg Why use Japanese Candlesticks? “He who is well prepared has won half the battle”.

Scene 6 (2m 25s)

. . 6. Bloomberg Intrinsic price movement and psychology “A thousand mile journey begins with the first step”.

Scene 7 (3m 9s)

. . 7. Enter 1 for a list of options. CAND RANGE O Type to review Japanese Candlestick signals SPOT Japan 8 A Bullish or White Candlestick implies that the closing price of the session was higher than the opening price. This means that buyers maintained control and prices spent more time pushing higher. A Bearish or Black Candlestick implies that the opening price of the session was higher than the closing price. This means that sellers maintained control and prices spent more time pushing lower. Real Body: The rectangle section of the Candlestick, called the 'real body', is the range between the session's open and close. The 'real body' represents overall commitment in the market and what Japanese chartists describe as 'the essence of market psychology'. Shadows: The thin lines extending out from Bullish/White or Bearish/Black Candlestick 'real bodies', are called 'shadows' (upper/lower) and highlight the price extremes for the session. The 'shadows' also tell us where momentum was offset. 7 Brazil sstt 3048 4500 Europe 44 20 7330 Germany 49 69 9204 1210 Hong Kong 852 2977 Singapore 63 6212 1000 US. 1 212 318 2000 Copyright Bloomberg F inarue L -P..

Scene 8 (4m 34s)

. . 8. Bloomberg CANDLESTICK PATTERNS: Single Session.

Scene 9 (5m 10s)

. . 9. Bloomberg CANDLESTICK PATTERNS: Single Session.

Scene 10 (5m 40s)

. . 10. Bloomberg CANDLESTICK PATTERNS: Single Session.

Scene 11 (6m 13s)

. . 11. Bloomberg CANDLESTICK PATTERNS: Single Session.

Scene 12 (6m 53s)

. . 12. Bloomberg CANDLESTICK PATTERNS: Single Session.

Scene 13 (7m 37s)

. . 13. Bloomberg CANDLESTICK PATTERNS: Single Session.

Scene 14 (8m 20s)

. . 14. Bloomberg CANDLESTICK PATTERNS: Two Session.

Scene 15 (8m 51s)

. . 15. Bloomberg CANDLESTICK PATTERNS: Two Session.

Scene 16 (9m 26s)

. . 16. Bloomberg CANDLESTICK PATTERNS: Two Session.

Scene 17 (10m 0s)

. . 17. Bloomberg CANDLESTICK PATTERNS: Two Session.

Scene 18 (10m 37s)

. . 18. Bloomberg CANDLESTICK PATTERNS: Two Session.

Scene 19 (11m 18s)

. . 19. Bloomberg CANDLESTICK PATTERNS: Three Session.

Scene 20 (12m 2s)

. . 20. Bloomberg CANDLESTICK PATTERNS: Three Session.

Scene 21 (12m 38s)

. . 21. Bloomberg CANDLESTICK PATTERNS: Three Session.

Scene 22 (13m 24s)

. . 22. Bloomberg CANDLESTICK PATTERNS: Three Session.

Scene 23 (14m 4s)

. . 23. Bloomberg CANDLESTICK PATTERNS: Three Session.

Scene 24 (14m 43s)

. . 24. Bloomberg CANDLESTICK PATTERNS: Three Session.

Scene 25 (15m 22s)

. . 25. Bloomberg CANDLESTICK PATTERNS: Three Session.

Scene 26 (16m 2s)

. . 26. Bloomberg CANDLESTICK PATTERNS: Three Session.

Scene 27 (16m 42s)

. . 27. Bloomberg CANDLESTICK PATTERNS: Three Session.

Scene 28 (17m 18s)

. . 28. Bloomberg CANDLESTICK PATTERNS: Multiple Session.

Scene 29 (18m 0s)

. . 29. Bloomberg SUMMARY: Japanese Candlesticks „Cheat Sheet‟.

Scene 30 (18m 54s)

. . 30. Bloomberg SUMMARY: Japanese Candlestick - Frequently Asked Questions Q1. How do you differentiate between a bullish and bearish candle? There are many different combinations of colours that people use to code candlestick patterns. Most popular are black/white and red/green. Sometimes it‟s best not to think of the colour coding of a candlestick and instead examine its construction logic. (See page 6). For example, a bullish (positive) session is where the market rises and closes higher < than it opens. This means that buyers maintained control. The opposite is true for a bearish (negative) session where the market falls and closes lower > than its opening price. Q2. What is the importance of the candlestick „real body‟ and shadow? Japanese candlestick analysts believe the rectangle section of a candlestick, otherwise known as the “real body” is “the essence of market psychology”, where the overall commitment is held. Meanwhile, shadows, which are the thin vertical lines (candle „wick‟) are the extreme price ranges for the session. They are also important and symbolize a yin-yang relationship. They indicate that momentum has been offset. Q3. What key principles should be used to confirm a candlestick signal? It‟s important to find a confluence of signals to provide the trade setup, thereby increasing the probability of a candlestick pattern‟s success. This is where Eastern methods meet with Western, compounding basic filters like trend, momentum to more sophisticated Ichimoku Kinko Hyo or Demark Indicators. Thereafter, it‟s advised to wait for price continuation and confirmation above a specific area before triggering a trade decision. Finally, each signal should offer an attractive risk/reward profile, so to ensure profitable longevity in the financial market. Q4. What are the best timeframes to use candlesticks? The great thing about Japanese candlesticks is they can be applied to all timeframes. In fact, by using multiple timeframes to confirm signals, we can significantly increase their success rate. At the s/t scale, 15 min intraday charts tend to be reliable, helping sharpen entry/exit points and for l/t confirmations, weekly charts are good. The most key proponents are mass psychology, liquidity and underline volatility. Q5. How do candlesticks differ between markets? There are subtle differences in characteristic between markets. These range from a market‟s unique volatility characteristic (which impacts the size of a candlestick) to the session‟s open and close defaults. This is most notable in the FX market where trading hours span 24hrs in three different time zones. On the major currency pairs, most are divided into the following three camps on which close to choose; i) simply defaulting to domestic region e.g. USA/Europe/Asia. ii) Using a strategic FX close that is impacted greatly by major economic events (this tends to be US centric). iii) Superior FX volume. London trading accounts for 31% of total FX volume. Where as the US only accounts for 19% FX volume. Q6. Which indicators should be used to confirm candlestick signals? To achieve a high probability of success it is best to choose a diversity of non-correlated indicators with a proven track record. One example would be to start with a momentum study that measures overbought/oversold extremes, such as RSI or Stochastics. This is because the majority of candlestick signals are „reversal‟ oriented and so indicators that anticipate reversals would work best. Q7. How accurate are candlestick signals? There have been several back-tested studies on the accuracy of candlestick signals. Results tend to vary and will of course depend on the chosen candle criteria, risk and money management profiles applied. Ultimately, Japanese candlestick analysis is seen as a strategic trading technique and not a system..