Page 1 (0s)

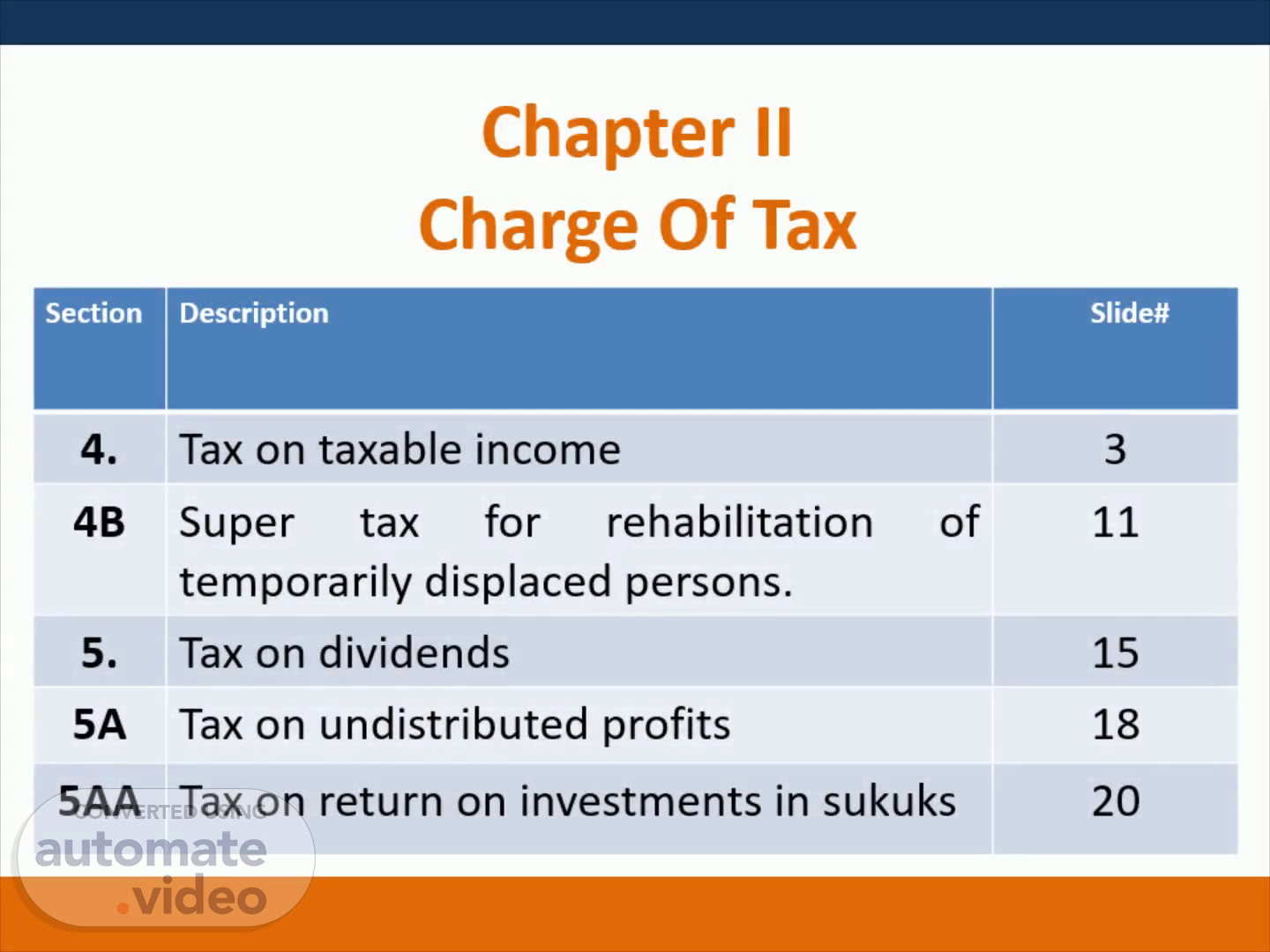

Chapter II Charge Of Tax. Section Description Slide# 4. Tax on taxable income 3 4B Super tax for rehabilitation of temporarily displaced persons. 11 5. Tax on dividends 15 5A Tax on undistributed profits 18 5AA Tax on return on investments in sukuks 20.

Page 2 (14s)

Section Description Slide# 6. Tax on certain payments to non-residents 23 7 Tax on shipping and air transport income of a non-resident person 26 7A Tax on shipping of a resident person 29 7B Tax on profit on debt 31 7C Tax on builders 34 7D Tax on developers 38 8. General provisions relating to taxes imposed under sections 5,6,7 42.

Page 3 (33s)

SECTION 4 tax on taxable income. Subject to this Ordinance, income tax shall be imposed for each tax year, at the rate or rates specified in Division I, or II of Part I of the First Schedule, as the case may be, on every person who has taxable income for the year..

Page 4 (50s)

T he rates of tax imposed on income of every individual and association of persons except a salaried individual shall be as set out in the following Table, namely.

Page 5 (2m 0s)

Where the income of an individual chargeable under the head “salary” exceeds seventy five percent of his taxable income, the rates of tax to be applied shall be as set out in the following Table ,.

Page 6 (3m 12s)

. 9. Where taxable income exceeds Rs. 12,000,000 but does not exceed Rs.30,000,000 Rs. 2,345,000 plus 27.5% of the amount exceeding Rs. 12,000,000 10. Where taxable income exceeds Rs. 30,000,000 but does not exceed Rs.50,000,000 Rs. 7,295,000 plus 30% of the amount exceeding Rs. 30,000,000 11. Where taxable income exceeds Rs. 50,000,000 but does not exceed Rs.75,000,000 Rs. 13,295,000 plus 32.5% of the amount exceeding Rs. 50,000,000 12. Where taxable income exceeds Rs.75,000,000 Rs. 21,420,000 plus 35% of the amount exceeding Rs. 75,000,000];.

Page 7 (3m 52s)

Rates of Tax for Companies. The rate of tax imposed on taxable income of a company, other than banking company shall be 32% for the tax year 2016. 31% for tax year 2017 and 30% for tax year 2018 and 29 % for tax year 2019 and onwards . Where the taxpayer is a small company , tax shall be payable at the rate of 25%..

Page 8 (4m 14s)

Section 4. (2) The income tax payable by a taxpayer for a tax year shall be computed by applying the rate or rates of tax applicable to the taxpayer under this Ordinance to the taxable income of the taxpayer for the year, and from the resulting amount shall be subtracted any tax credits allowed to the taxpayer for the year..

Page 9 (4m 32s)

SECTION 4. Where a taxpayer is allowed more than one tax credit for a tax year, the credits shall be applied in the following order – ( a) any foreign tax credit allowed under section 103; then ( b) any tax credit allowed under Part X of Chapter III; and then (c ) any tax credit allowed under sections 147 and 168. Certain classes of income (including the income of certain classes of persons) may be subject to - separate taxation as provided in sections 5, 6 and 7; or collection of tax under Division II of Part V of Chapter X or deduction of tax under Division III of Part V of Chapter X as a final tax on the income of the person..

Page 10 (5m 0s)

SECTION 4. (5) Income referred to in sub-section (4) shall be subject to tax as provided for in section 5, 6 or 7, or Part V of Chapter X, as the case may be, and shall not be included in the computation of taxable income in accordance with section 8 or 169, as the case may be . Where, by virtue of any provision of this Ordinance, income tax is to be deducted at source or collected or paid in advance, it shall, as the case may be, be so deducted, collected or paid, accordingly..

Page 11 (5m 26s)

SECTION 4B Super tax for rehabilitation of temporarily displaced persons.

Page 12 (6m 1s)

SECTION 4B. (2) For the purposes of this section, “income” shall be the sum of the following :- ( i ) profit on debt, dividend, capital gains, brokerage and commission; (ii) taxable income 6[(other than brought forward depreciation and brought forward business losses)] under section (9 ) of this Ordinance ; (iii) imputable income as defined in clause (28A) of section 2;and (iv) income computed (other than brought forward depreciation, brought forward amortization and brought forward business losses)under Fourth, Fifth, Seventh and Eighth Schedule..

Page 13 (6m 24s)

SECTION 4 B. (3) The super tax payable under sub-section (1) shall be paid, collected and deposited on the date and in the manner as specified in sub-section (1) of section 137 and all provisions of Chapter X of the Ordinance shall apply . (4) Where the super tax is not paid by a person liable to pay it, the Commissioner shall by an order in writing, determine the Super tax payable, and shall serve upon the person, a notice of demand specifying the super tax payable and within the time specified under section 137 of the Ordinance ..

Page 14 (6m 49s)

SECTION 4B. ( 5) Where the super tax is not paid by a person liable to pay it, the Commissioner shall recover the super tax payable under sub-section (1) and the provisions of Part IV, X, XI and XII of Chapter X and Part I of Chapter XI of the Ordinance shall, so far as may be, apply to the collection of super tax as these apply to the collection of tax under the Ordinance. (6) The Board may, by notification in the official Gazette, make rules for carrying out the purposes of this section ..

Page 15 (7m 14s)

SECTION 5 Tax on dividends. Tax shall be imposed, at the rate specified in Division III of Part I of the First Schedule, on every person who receives a dividend from a company or treated as dividend under clause (19) of section 2..

Page 16 (7m 28s)

SECTION 5 Rate of Dividend Tax. The rate of tax imposed under section 5, on dividend received from a company shall be- 7.5 % in case of dividend paid by Independent Power 29[Producers] where such dividend is a pass through item under an Implementation Agreement or Power Purchase Agreement or Energy Purchase Agreement and is required to be re- imbursed by Central Power Purchasing Agency (CPPA-G) or its predecessor or successor entity . 15 % in mutual funds 30[, Real Estate Investment Trusts] and cases other than those mentioned in clauses (a) and (c). 25% in case of a person receiving dividend from a company where no tax is payable by such company, due to exemption of income or carry forward of business losses under Part VIII of Chapter III or claim of tax credits under Part X of Chapter III.].

Page 17 (8m 2s)

SECTION 5 TAX ON DIVIDENDS. The tax imposed under sub-section (1) on a person who receives a dividend shall be computed by applying the relevant rate of tax to the gross amount of the dividend. This section shall not apply to a dividend that is exempt from tax under this Ordinance..

Page 18 (8m 17s)

SECTION 5A Tax on undistributed profits. For tax years 2017 to 2019 a tax shall be imposed at the rate of 5% of its accounting profit before tax on every public company, other than a scheduled bank or a modaraba , that derives profit for a tax year but does not distribute at least 20% of its after tax profits within six months of the end of the tax year through cash . Provided that for tax year 2017, bonus shares or cash dividends may be distributed before the due date mentioned in sub-section (2) of section 118, for filing of a return..

Page 19 (8m 43s)

SECTION 5 A Tax on undistributed profits. ( 2) The provisions of sub-section (1) shall not apply to- a company qualifying for exemption under clause (132) of Part I of the Second Schedule; and a company in which not less than fifty percent shares are held by the Government..

Page 20 (8m 58s)

SECTION 5AA Tax on return on investments in sukuks.

Page 21 (9m 12s)

SECTION 5AA Tax on return on investments in sukuks.

Page 22 (9m 37s)

SECTION 5AA Tax on return on investments in sukuks.

Page 23 (9m 56s)

SECTION 6 Tax on certain payments to non-residents..

Page 24 (10m 12s)

SECTION 6 Tax on certain payments to non-residents ..

Page 25 (10m 29s)

SECTION 6. (3) This section shall not apply to – any royalty where the property or right giving rise to the royalty is effectively connected with a permanent establishment in Pakistan of the non-resident person; (b) any fee for technical services where the services giving rise to the fee are rendered through a permanent establishment in Pakistan of the non-resident person; or (c) any royalty or fee for technical services that is exempt from tax under this Ordinance. (4) Any Pakistani-source royalty fee for offshore digital services or fee for technical services received by a non-resident person to which this section does not apply by virtue of clause (a) or (b) of sub-section (3) shall be treated as income from business attributable to the permanent establishment in Pakistan of the person..

Page 26 (11m 0s)

SECTION 7 Tax on shipping and air transport income of a non-resident person.

Page 27 (11m 27s)

SECTION 7 Tax on shipping and air transport income of a non-resident person.

Page 28 (11m 43s)

SECTION 7. (2) The tax imposed under sub-section (1) on a non-resident person shall be computed by applying the relevant rate of tax to the gross amount referred to in sub-section (1 ). ( 3) This section shall not apply to any amounts exempt from tax under this Ordinance..

Page 29 (11m 58s)

SECTION 7A Tax on shipping of a resident person. (1) In the case of any resident person engaged in the business of shipping , a presumptive income tax shall be charged in the following manner, namely :- ships and all floating crafts including tugs, dredgers, survey vessels and other specialized craft purchased or bare-boat chartered and flying Pakistan flag shall pay tonnage tax of an amount equivalent to 1 US$ per gross registered tonnage per annum ships, vessels and all floating crafts including tugs, dredgers, survey vessels and other specialized craft not registered in Pakistan and hired under any charter other than bare-boat charter shall pay tonnage tax of an amount equivalent to fifteen US cents per ton of gross registered tonnage per chartered voyage provided that such tax shall not exceed 1 US$ per ton of gross registered tonnage per annum:.

Page 30 (12m 33s)

SECTION 7A Tax on shipping of a resident person. Explanation .- For the purpose of this section, the expression “equivalent amount” means the rupee equivalent of a US dollar according to the exchange rate prevalent on the first day of December in the case of a company and the first day of September in other cases in the relevant assessment year 3 and c) A Pakistan resident ship owning company registered with the Securities and Exchange Commission of Pakistan after the 15th day of November, 2019 and having its own sea worthy vessel registered under Pakistan Flag shall pay tonnage tax of an amount equivalent to seventy five US Cents per ton of gross registered tonnage per annum . (2) The provisions of this section shall not be applicable after 30th June, 2030..

Page 31 (13m 5s)

SECTION 7B Tax on profit on debt. T ax shall be imposed, at the rate specified in Division IIIA of Part I of the First Schedule, on every person who receives a profit on debt from any person mentioned in clause (a) to (d) of sub-section (1) of section 151. (2) The tax imposed under sub-section (1) on a person who receives a profit on debt shall be computed by applying the relevant rate of tax to the gross amount of the profit on debt..

Page 32 (13m 27s)

SECTION 7 B. (2) The tax imposed under sub-section (1) on a person who receives a profit on debt shall be computed by applying the relevant rate of tax to the gross amount of the profit on debt..

Page 33 (13m 44s)

SECTION 7B. This section shall not apply to a profit on debt that (a) is exempt from tax under this Ordinance; or (b) exceeds five million Rupees ..

Page 34 (13m 55s)

SECTION 7C Tax on builders. T ax shall be imposed on the profits and gains of a person deriving income from the business of construction and sale of residential, commercial or other buildings at the rates specified in Division VIIIA of Part I of the First Schedule ..

Page 35 (14m 9s)

Tax on builders. Division VIIIA of Part I of the First Schedule. (A) Karachi, Lahore and Islamabad (B) Hyderabad, Sukkur, Multan, Faisalabad, Rawalpindi, Gujranwala, Sahiwal, Peshawar, Mardan,Abbottabad , Quetta (C) Urban Areas not specified in A and B For commercial buildings Rs. 210/ Sq Ft Rs. 210/ Sq Ft Rs. 210/ Sq Ft For residential buildings Area in Sq. ft Rate/ Sq. Ft Area in Sq. ft Rate/ Sq. Ft Area in Sq. ft Rate/ Sq. Ft Up to 750 Rs. 20 Up to 750 Rs. 15 Up to 750 Rs. 10 751 to 1500 Rs. 40 751 to 1500 Rs. 35 751 to 1500 Rs. 25 1501 & more Rs. 70 1501 & more Rs. 55 1501 & more Rs. 35.

Page 36 (14m 45s)

Tax on builders. (2) The tax imposed under sub-section (1) shall be computed by applying the relevant rate of tax to the area of the residential , commercial or other building being constructed for sale . (3) The Board may prescribe : the mode and manner for payment and collection of tax under this section; the authorities granting approval for computation and payment plan of tax; and responsibilities and powers of the authorities approving, suspending and cancelling no objection certificate to sell and the matters connected and ancillary thereto..

Page 37 (15m 8s)

Tax on builders. 4) This section shall apply to projects undertaken for construction and sale of residential and commercial buildings initiated and approved .- during tax year 2017 only; for which payment under rule 13S of the Income Tax Rules, 2002 has been made by the developer during tax year 2017; and the Chief Commissioner has issued online schedule of advance tax installments to be paid by the developer in accordance with rule 13U of the Income Tax Rules, 2002 ..

Page 38 (15m 30s)

SECTION 7D Tax on developers. Subject to this Ordinance, a tax shall be imposed on the profits and gains of a person deriving income from the business of development and sale of residential, commercial or other plots at the rates specified in Division VIIIB of Part I of the First Schedule . The tax imposed under sub-section (1) shall be computed by applying the relevant rate of tax to the area of the residential, commercial or other plots for sale..

Page 39 (15m 52s)

Tax on developers. Division VIIIB of Part I of the First Schedule. (A) Karachi, Lahore and Islamabad (B) Hyderabad, Sukkur, Multan, Faisalabad, Rawalpindi, Gujranwala, Sahiwal, Peshawar, Mardan,Abbottabad , Quetta (C) Urban Areas not specified in A and B For commercial buildings Rs. 210/ Sq Ft Rs. 210/ Sq Ft Rs. 210/ Sq Ft For residential buildings Area in Sq. ft Rate/ Sq. Ft Area in Sq. ft Rate/ Sq. Ft Area in Sq. ft Rate/ Sq. Ft Up to 120 Rs. 20 Up to 120 Rs. 15 Up to 120 Rs. 10 121 to 200 Rs. 40 121 to 200 Rs. 35 121 to 200 Rs. 25 201 & more Rs. 70 201 & more Rs. 55 201 & more Rs. 35.

Page 40 (16m 27s)

SECTION 7D Tax on developers. (3) The Board may prescribe : the mode and manner for payment and collection of tax under this section; the authorities granting approval for computation and payment plan of tax; and responsibilities and powers of the authorities approving, suspending and cancelling no objection certificate to sell and the matters connected and ancillary thereto..

Page 41 (16m 45s)

SECTION 7D Tax on developers. (4) This section shall apply to projects undertaken for development and sale of residential and commercial plots initiated and approved .- during tax year 2017 only; for which payment under rule 13S of the Income Tax Rules, 2002 has been made by the developer during tax year 2017; and the Chief Commissioner has issued online schedule of advance tax installments to be paid by the developer in accordance with rule 13ZB of the Income Tax Rules, 2002..

Page 42 (17m 7s)

SECTION 8 General provisions relating to taxes imposed under sections 5 , 5AA 6, 7, 7A and 7B.

Page 43 (17m 35s)

SECTION 8 General provisions relating to taxes imposed under sections 5, 5AA 6, 7, 7A and 7B.